Direct Earnings Attachment

In this article, we will cover what a Direct earnings attachment is, how you get one and what to do if you do receive one.

It can be understandably a very confusing process for people who have never received anything like this before.

Table of Content

What is a direct earnings attachment order?

A Direct Earnings Attachment (DEA) is issued when you have been overpaid benefits or had tax credit overpayments.

The amount you have been overpaid will be taken directly out of your monthly wages, however, you should be contacted before they start to take any payment.

Your employer will be contacted about the benefit overpayments. They will then be advised how much to take for the DEA deductions from their employee’s net earnings.

Your employer can also be asked to make deductions for housing benefit overpayments if that happens the employer would need to contact the local authorities.

Will I be taken to court if I get a DEA?

Thankfully when you receive a direct earnings attachment, a court order will not be issued against you.

This is because it is not technically your fault that you have to pay this money back

Find Out The Best Debt Solution Bespoke To Your Financial Situation

30 Second Debt Assessment QuizHow much can be taken if a DEA is applied?

The monthly deduction rates are taken from your net earnings after the deduction of income tax, national insurance, and workplace pension contributions.

When a direct earnings attachment is issued there are three different options available.

There is a standard rate DEA this is where the maximum percentage that can be taken is 20%, they can also request a higher rate.

A higher rate can take up to 40% of your net earnings. A higher rate is only applied if you earn over a certain amount every month/week.

For example, if you are paid £1500 per month the amount you pay with the standard rate would be £300 each month of your net earnings.

They can also set a fixed rate where you and the creditor agree on a fixed amount every month.

Did You Know You Can Write Off Up To 85% Of Your Debts?

Do I Qualify?Can you stop a direct earnings attachment?

In some cases, you can stop direct earnings attachments if you contact the creditor as soon as possible to offer to pay what you owe in monthly installments.

It is also important that you make it clear how much you can afford to pay each month.

If the creditors agree to the repayment plan you have proposed, a DEA will not be enforced as long as you are earning some sort of income.

The following are counted as earnings: wages and salary, bonuses, overtime, and if you are paid with wages or salary compensation payments.

You do have the right to argue that you have not been overpaid but there is no guarantee that you will win the argument.

If you strongly believe that you have not been overpaid it is worth challenging the issue.

Will a DEA affect my credit score?

A DEA thankfully will not affect your credit score since you haven’t taken out any sort of loan or defaulted on a card.

If you do, however, think that a DEA will send you into debt you can let the local authority know and then you can consider taking debt advice,

You may even be able to write off your debt with a debt relief order.

Do Not Speak to Debt Solicitors Until You Know About This?

Find Out MoreThe Journey of Debt

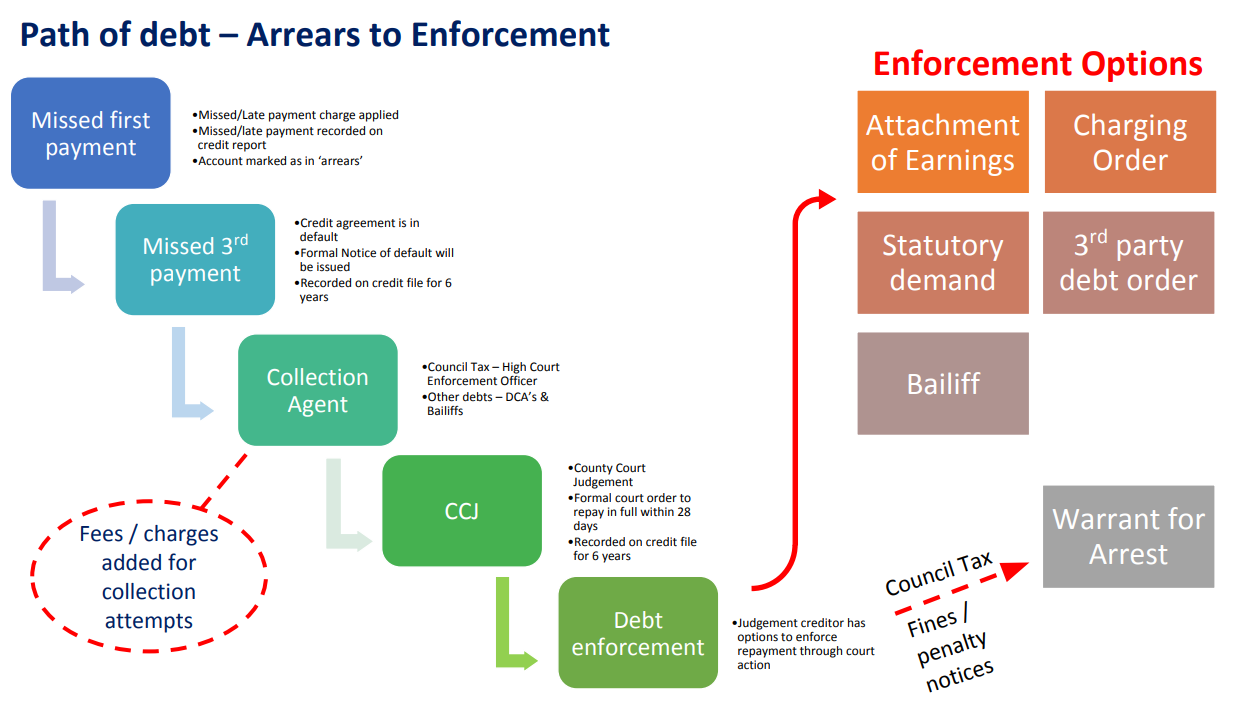

Here is the path of debt – from arrears to enforcement.

- Missed First Payment – Marked as in ‘arrears’

- Missed 3rd Payment – Formal Notice of Default

- Collection Agent

- CCJ – County Court Judgement

- Debt Enforcement – Attachment of Earnings

- Debt Enforcement – Charging Order

- Debt Enforcement – Statutory Demand

- Debt Enforcement – Warrant for Arrest

- Debt Enforcement – 3rd Party Debt Order

- Debt Enforcement – Bailiff

Summary

You cannot go to court over direct earnings attachments and the money owed can be very easily paid off to suit your budget.

Depending on your net earnings a standard or a higher rate of deductions can be taken but this will be assessed before the DEA is issued.

Overall it’s nothing much to worry about if you do get a DEA issued to you. It can be easily resolved.

List of UK Solicitors Chasing Debts

Here is a list of UK Solicitors Chasing debt.

- Attachment of Earnings Order

- Direct Earnings Attachment

- Solicitors Letter Before Action

- Solicitors Letter threatening Court Action for Debts

- The Ultimate Guide to Andrew James Enforcement Ltd

- The Ultimate Guide to ARP Enforcement Agency

- The Ultimate Guide to Chandlers Enforcement Agents

- The Ultimate Guide to Confero Collections Ltd

- The Ultimate Guide to Constant & Co

- The Ultimate Guide to Court Enforcement Services Ltd

- The Ultimate Guide to CPER Bailiffs

- The Ultimate Guide to Debt Guard Solicitors

- The Ultimate Guide to DG Collection Services Ltd

- The Ultimate Guide to Dukes Bailiffs Ltd

- The Ultimate Guide to Elliot Davies High Court & Civil Enforcement

- The Ultimate Guide to Excel Civil Enforcement

- The Ultimate Guide to Gladstones Solicitors

- The Ultimate Guide to Goodwillie & Corcoran

- The Ultimate Guide to High Court Enforcement Group

- The Ultimate Guide to JTR Collections

- The Ultimate Guide to Lightfoots Debt Recovery

- The Ultimate Guide to Moriarty Law

- The Ultimate Guide to Mortimer Clarke Solicitors

- The Ultimate Guide to One Source Debt Resolution

- The Ultimate Guide to Proserve Debt Recovery & Bailiff Service Ltd

- The Ultimate Guide to QDR Solicitors

- The Ultimate Guide to Restons Debt Collectors

- The Ultimate Guide to Reventus Enforcement Agents

- The Ultimate Guide to Ross & Roberts Enforcement Agents

- The Ultimate Guide to Rundles

- The Ultimate Guide to Solex Legal Services

- The Ultimate Guide to Spratt Endicott Debt Recovery

- The Ultimate Guide to Whyte & Co

- The Ultimate Guide to Wilson & Roe High Court Enforcement Ltd