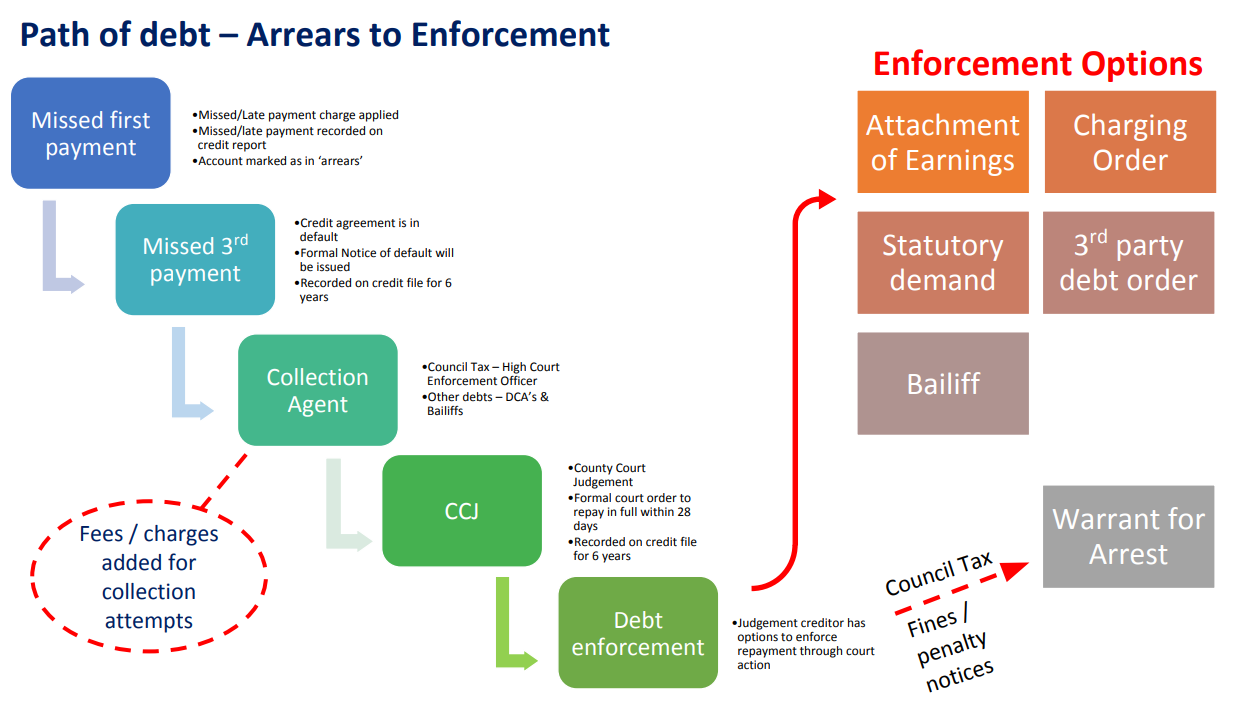

The Path Of Debt explains each step in the journey from initially missing the first payment to potential warrants for arrest on debts outstanding.

There are various advancements that your creditor might take to try and reclaim outstanding debts that are owed to them. Each stage has its own terms and conditions that the debtor should be made aware of.

This article will cover each step that a creditor can take to collect the money they are owed from their debtors.

If you find yourself falling further into debt, then it is always advisable to seek out professional debt advice from a debt advisory service. There is a range of suitable debt solutions designed to help struggling individuals work their way out of financial insecurity.

Table of Content

- 1 Missed First Payment – Marked as in ‘arrears’

- 2 Missed 3rd Payment – Formal Notice of Default

- 3 Collection Agent

- 4 CCJ – County Court Judgement

- 5 Debt Enforcement – Attachment of Earnings

- 6 Debt Enforcement – Charging Order

- 7 Debt Enforcement – Statutory Demand

- 8 Debt Enforcement – Warrant for Arrest

- 9 Debt Enforcement – 3rd Party Debt Order

- 10 Debt Enforcement – Bailiff

- 11 Debt Solutions

- 12 Summary

Missed First Payment – Marked as in ‘arrears’

The first missed payment may not seem to be a big deal and you may believe you won’t have any repercussions, however, you would be wrong.

Missing even one payment can have a detrimental effect on your credit rating, alongside other possible consequences.

Other outcomes could be:

- Receiving a missed payment fee.

- The potential to lose your promotional interest offer.

- An increase in your interest rates.

- Difficulty with other aspects of your finances, such as taking out additional loans.

The first missed payment will be marked as in arrears on your credit file, highlighting to other creditors and banks that you have failed to keep up with your monthly instalments.

Missed 3rd Payment – Formal Notice of Default

If you miss multiple payments, then you will be sent a default notice. A default notice informs the debtor that they have 14 days to catch up with their overdue payments or a default will be added to their credit file.

If complete payment isn’t made before the 14 days is up, then a default is added to your credit report, and it will stay there for up to 6 years.

A default notice is a final step that a creditor must take before they can pursue further legal action, such as issuing a county court judgement or charging order.

Due to the negative consequences that can follow notice of default, the default notice should be taken extremely seriously and you should take action to try to ensure you repay your debts within the 14-day period.

Collection Agent

Your creditor can hire a debt collection agency to try and chase you for payment. Debt collectors can show up at your door and pressure you to make a payment to clear your debts.

There are certain things that debt collectors are not permitted to do, such as threatening you, showing up at unreasonable times, forcing entry into your home or contacting you at work.

You do not have to pay the debt collection agent then and there, first you should check that the debt is yours and that the bailiff is who they say they are. You can even ask to set up a payment plan rather than make a one-off payment.

If you are unsure what rights debt collection agents have, you should contact a debt advisory service that can provide you with professional advice on how to deal with bailiffs.

Find Out The Best Debt Solution Bespoke To Your Financial Situation

30 Second Debt Assessment QuizCCJ – County Court Judgement

A county court judgment is a court order that your creditor can take out against you in an effort to reclaim their money.

The CCJ forces the debtor to repay the money that they owe their creditor. Once you make a payment in full your CCJ is noted as a CCJ discharged on your credit file, demonstrating to future creditors that you had a CCJ against you but you made a complete repayment.

It is important that you pay off your CCJ as if you don’t get the CCJ discharged it will remain on your credit file for 6 years.

Debt Enforcement – Attachment of Earnings

An attachment of earnings order enables your creditor to take direct repayment from your wages, to pay off the money which the debtor owes them.

The court will take into account your essential expenditure and calculate how much will be taken from your wages and sent to your creditor.

If your take-home pay falls below the protected earnings rate, then your creditor will not be permitted to take out an attachment of earnings order.

If an attachment of earnings is permitted, then the debtor’s employer will send their wage to the court, and the court will distribute the payments accordingly.

Debt Enforcement – Charging Order

A charging order changes unsecured debt to secured debt, by securing the debtor’s property as collateral for unpaid debts.

If you sell or remortgage your home with a charging order against you, then your debts will be paid off using the profits from the sale of assets.

Your creditor can only apply for a charging order if they have already taken out a county court judgement.

The process of applying for a charging order includes an interim and final order. You can object to an interim charging order within 28 days if any of the following terms apply:

- You haven’t missed any CCJ payments.

- You have no equity.

- If you have multiple creditors who aren’t requesting a charging order.

- You joint own your property.

Debt Enforcement – Statutory Demand

A statutory demand is a formal notice that informs the debtor that their creditor will file to make them insolvent if they do not take significant steps to repay their debts.

The statutory demand makes it clear that without repayment, the creditor will force the debtor to file for bankruptcy.

You can make repayments via a one-off payment or in instalments, but to avoid facing liquidation or bankruptcy it is essential to address the statutory demand as soon as possible.

To learn what terms may entitle you to set aside a statutory demand, then read our informative article.

Debt Enforcement – Warrant for Arrest

There may be a preconception that a bailiff or debt collection agent can issue a warrant for your arrest if you have outstanding debt, whereas typically this is not the case.

An approved enforcement agent might be granted the power to chase a warrant for arrest provided the debtor in question has broken a community penalty order.

If you have failed to repay priority debts, then there may be a chance that you will have a warrant put out for your arrest, however, this is often the last resort and isn’t commonly put into practice.

While you might not be arrested, bailiffs can reclaim possessions and even force entry to your property if you have not paid priority debts.

Do Not Speak to Debt Solicitors Until You Know About This?

Find Out MoreDebt Enforcement – 3rd Party Debt Order

A third-party debt order permits your creditor to take owed money directly from the bank or building society that is holding the funds.

Your creditor must file for an interim order and a final order before they are allowed to take any money from your bank accounts. However, once an interim order has been confirmed, your money will be frozen which can make areas of your finances, such as paying bills, more difficult.

A third-party order is usually the next step if you have failed to meet the terms of a CCJ or a charging order.

You can apply for a hardship payment order if you believe the 3rd party debt order will make it extremely difficult for you to pay essential expenditures or if the debt order will impact children or other vulnerable adults.

Debt Enforcement – Bailiff

If you fail to pay off your debts, eventually, you may have a bailiff officer show up at your door. Bailiffs can be intimidating and you should educate yourself on what rights you have when dealing with enforcement agents.

Bailiffs do not possess the same powers as the police and there are many actions they are not authorised to take, such as:

- Forcing entry without a warrant.

- Refusing to show valid identification.

- Contacting you at unreasonable hours.

- Showing up unannounced.

And so on. If you are concerned about dealing with bailiffs, you can get in touch with a debt help charity that can provide qualified advice on how to handle your communications with bailiffs.

If you do let a bailiff into your home, then they are authorised to repossess certain assets as collateral, including televisions, bikes and other vehicles.

Debt Solutions

When analysing your credit report and current debtors it is advised to understand all the debt solutions available to you.

Here are all the UK debt solutions available to you depending on where you are based in the UK:

- Best DAS Companies

- Best Full and Final Companies

- Best IVA Companies in Manchester

- Best IVA Companies UK

- Best Sequestration Companies

- Best Trust Deed Companies

- Debt Consolidation Companies

- Debt Relief Order Companies

- DMP Companies

Summary

There are many steps that a creditor can take in an attempt to reclaim money that is owed to them by a debtor.

The steps get increasingly more serious and you should take every effort to repay your debts as soon as possible to ensure matters don’t escalate in severity.

If you continue to ignore the action being taken against you, then it could result in your property and other possessions being taken by bailiffs.

Failing to repay priority debts could even result in a warrant for your arrest being issued. So, it is highly important that you face your debts head-on and find a suitable debt solution that will help you climb out of overwhelming financial struggles.

Did You Know You Can Write Off Up To 85% Of Your Debts?

Do I Qualify?